Contents

Overviews

Goal

Business Strategy

Capital Requirements

Timeline

Investment Opportunity

Products and Services

Company

Other

Details

Market

Existing products and services

Pipeline products and services

Scalability

Company History & structure/related entities

Key Assets, Contracts & IP

Funding & Use of Funds (inc R&D)

Offer details

Board of Directors and Directors

Senior Management

Remuneration / Compensation of Senior Management

Corporate Governance

Shareholders

Dividends, Dividend Policy and Stock Options

Description of the Company's Shares

Material Transactions / Agreements with Major Shareholders

Material Transactions / Agreements with Senior Management

Other Conflicts of Interests

Investor Information: Incentives, Deal structure

Legal Proceedings / Litigations

Team / structure (our background)

Risks & Mitigation

Revenue Models

Competitors

MFA product highlights

Exit

Comparable Industry acquisitions

Conditions

How to Invest

Appendix

1id Inc Bylaws and Articles of Association

CryptoPhoto.com Pty. Ltd. Articles of Association

Adobe PDF version of this Prospectus

Overviews:

Goal

This offering is to raise money to fund the recruitment of professional enterprise-security-sales teams and provide the tools and resources they need to accelerate CryptoPhoto global sales.

We are selling 10% to 20% of our equity through this offering in the form of traditional company shares, but represented in tokenized form (CP Tokens) on the blockchain.

Profits arising from sales or other activity will be distributed to shareholders also through the blockchain. Liquid capital-gains will be available to shareholders from day one through our exchange relationship which will facilitate 24/7 token trading starting at the commencement of our offering.

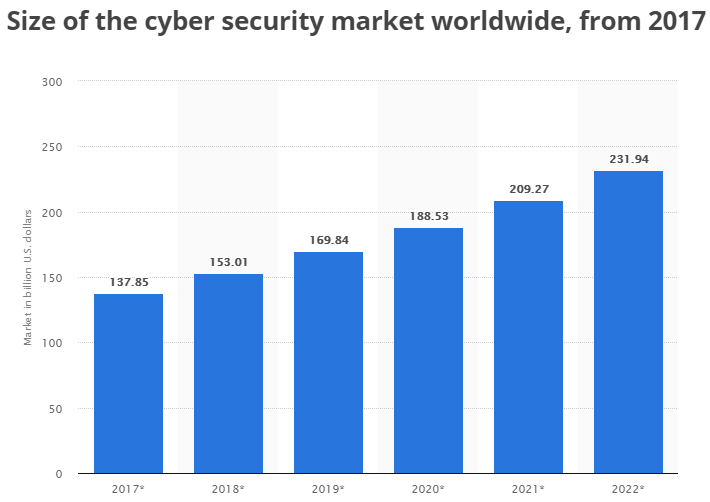

Our goal is to take a market-leadership position in the $153 billion dollar cyber-security industry and to profit from keeping end users safe online while protecting organizations against attack.

Business Strategy

In one word: sales. Our technology is already enjoying market adoption, protecting (as at July 2018) 31,000+ users across 439+ diverse providers and businesses, and we have signed valuable agreements to integrate with more, including core banking platforms and world-leading cyber security vendors. We have won dozens of prestigious awards, consistently rank top in competitions, ratings, and tests, and our technology outstrips all our competitors in terms of security breadth, ease-of-use, and capability.

The funds raised through this offering will recruit and support specialist cyber-security sales experts. We believe the combination of world-leading cyber-protection in the hands of a world-leading cyber salesforce will deliver outstanding sales success in a relatively short timeframe. To maximize the efficacy of our sales experts in their respective locations and cultures, their first tasks will be to plan their own sales strategies. Without limiting their freedom, we expect most early high-value sales will come through one-on-one personal direct enterprise sales activities and business networking. We also anticipate that early successful strategies, when shared across our regional teams, will provide a halo effect.

Capital Requirements

We are raising $10M to fund five professional sales teams in five key strategic global locations; Silicon Valley, New York, London, Chennai, and Sydney/APAC. These locations cover most of the world's Internet Technology capitals, the world's most important banking regions, and multiple strategic partner locations. In the event we are oversubscribed, we have reserved a second 10% equity to be available to fulfil subscriber demand, at increasing multiples (2.5% at 2.5x, 2.5% at 5x, and 5% at 10x) of the initial offering price. In the event we are fully subscribed, a total of $78.75M would be raised. Any funds in excess of our $10M will be put towards additional teams in more locations, and boosting existing team sizes and resources where appropriate. If we fail to reach our $10M target by a long margin, we will refund all payments and cancel our ICO. If we fail, but get close, to our target, we may choose to proceed with reduced numbers of teams or team sizes/resource limits.

We chose 10% for $10M to value our business at $100M, which is approximately equal to the cash price paid for several comparable, recent and young multifactor vendors in our industry. Established vendors with comparable technology and modest traction have recently been acquired for $1bn or more. Cisco bought DUO for $2.35bn this month; our technology is vastly superior. See the later section "Comparable Industry acquisitions" for more examples.

Timeline

We have retained the services of an expert recruitment firm, experienced with locating and acquiring the sales professionals we need in our teams. We will provide the go-ahead as soon as we reach sufficient raised funds.

We will be operating a Transparent Open Company (TOCO)*, which will allow everyone to track our offering progress on the blockchain, and allows all shareholders access to our real-time financial records. As an investor, you'll have a front-row seat to view our raise and our subsequent business spending and reporting in real time.

*TOCO - the Transparent Open-Company operating principal places all company transactions on the public blockchain in real-time, including ERC1111-formatted GAAP/IFRS accounting code metadata. This means that authorized parties, including shareholders, can watch on-chain transactions and determine the meaning of them. This allows for real-time production of a complete set of compliant financial accounts for a business. In other words, this is a little bit like "Securities and Exchange Commission Mandatory Disclosure Reporting", like Form-10K etc, except instead of old and once-per-year, you get live and real-time. Cryptography is used to prevent unauthorized access, and if necessary, to delay revelation of any time-sensitive matters.

Investment Opportunity

Based on comparable industry performance, we have priced our offering to deliver a plausible 10x capital-gain return on investment for our early investors (those in our initial 10% offering). If we are oversubscribed, early investors will be able to immediately take returns (depending on any oversubscription volume) of up to 2.5x, or up to 5x, or up to 10x, should they choose to sell their investment below our contingency offerings.

We are a traditional enterprise-sales-model cyber-business, with additional B2B and B2C opportunities and pipeline products, operating in a rapidly growing $153bn market.

Business profits will be returned to investors in the form of dividends, paid on the blockchain.

We make use of a dividend payment scheme based on buybacks and continuous dividends (both at once, not individually), which delivers highly-liquid capital-gain improvements,

as well as dividend profit distribution payments, directly to shareholder wallets in real time.

This works as follows: when it comes time to pay dividends, we first purchase the total value worth of dividends in the form of CP tokens from existing shareholders who have them for sale (this will typically increase the price of CP tokens,

because we have temporarily reduced the supply).

Moments later, we distribute these purchased CP tokens among the remaining shareholders.

Our exchange relationship facilitates programmable trading, and will in future allow dividends to immediately convert to the payment method of your choice, be that tokens, cryptocurrencies, and/or fiat currencies.

Our incorporation in the Marshall Islands ensures that no taxes or withholdings are imposed at source, which greatly simplifies your own tax affairs.

Besides investment gains and dividend payments, CryptoPhoto also, of course, delivers you another valuable benefit: online safety. Cybercrime costs more than the entire global drug trade - that money comes out of the pockets of you, your family, and friends etc. If they're not a direct actual victim themselves, keep in mind that you still bear the cost of fraud in the form of increased prices on goods and services, increased taxes, levies, fees, and interest, and so on. CryptoPhoto helps prevent all that.

Full information about CryptoPhoto, the world's simplest and most powerful security system, developed by Chris Drake, author of the world's most cited security patent, can be seen at CryptoPhoto.com.

You can buy CryptoPhoto shares in the form of CP tokens immediately, using any form of payment, by visiting our exchange partner CryptInc.com.

Products and Services

CryptoPhoto offers world-leading and patent-granted authentication and digital signing products and services which are already fully developed (production ready and in widespread use already).

Our development pipeline includes patent-pending anti-fraud and invisible robot-detection solutions, patent-granted advanced machine-protection tools, and other cyber-security innovations.

Our existing connectors make it fast and easy to use our flagship authentication solution for a huge range of purposes, including online (website, server, workstation, etc) authentication, authorization, and transaction signing, offline (telephone and in-person) support for all those things, and Internet-of-Things (IoT) use cases, to name just a few.

See our website CryptoPhoto.com for full details, and see the "Existing/Pipeline products and services" sections below for current and future plans.

Company

CryptoPhoto is wholly owned by 1id inc (Reg. No. 96956), incorporated in the crypto-friendly and ICO-accommodating jurisdiction of the Marshall Islands - the world's first country to issue its own sovereign legal tender on the blockchain.

CryptoPhoto operates globally through other entities, including the Australian-Registered company CryptoPhoto.com Pty Ltd. All income is returned using globally accepted accounting mechanisms to 1id inc for distribution to shareholders.

There is no withholding on dividends, no company tax, no capital gains tax, and no shareholder taxes on 1id inc in the Marshall Islands. Taxation of shareholder dividends and other gains will depend on each shareholder's own tax jurisdiction and arrangements.

Offer

We are calling our tokens, (or shares), "CP"s, to distinguish them from the (different kind of) tokens we use in CryptoPhoto operations.

Our tokens (shares) can be purchased*, and will be immediately** tradeable, on our partner exchange according to the following table:-

10% equity will be for sale in the order book for $10M @ 0.0001 USD / CP

2.5% contingency will be temporarily available for $6.25M @ 0.00025 USD / CP

2.5% contingency will be temporarily available for $12.5M @ 0.0005 USD / CP

5% contingency will be temporarily available for $50M @ 0.001 USD / CP

Minimum viable raise will be 2% for $2M, and will fund reduced-speed operations.

Maximum equity available during the offering is 20%, for a total of $78.75M USD.

** Some payment methods, like Credit Cards, will not allow the buyers to trade until a mandatory chargeback-protection period has expired (for example: to protect our business against fraudulent chargebacks).

Pricing is available until sold out (the first 10%), or until sold out or withdrawn (the contingency 10%). Unsold contingency orders will be cancelled approximately 30 days after successful fulfilment of our initial 10%.

No other equity will be sold during the offering period.

Staff, employees, developers, advisors and our share-option-plan account for 6% of our equity [pre-allocated - not part of this sale]. To maximize investor fairness, and minimize adverse pricing effects, this will not be available for sale until 6 months after the close of our offering, and will vest proportionally over a subsequent 18 month period - after the offering, there will not be a date when any large number of these tokens will be suddenly available for sale.

Balance - Reserved. Not for sale, locked for 12-months or earlier if approved by majority vote of shareholders (i.e. you). If later offered for sale, a minimum of 3 months notice of intention will be published. This balance is owned and/or controlled by CryptoPhoto founders and/or associates.

* This offering is not available to Cuba, Iran, North Korea, Marshall Islands, Sudan, Syria, Venezuela, or any peoples or companies thereof, nor in any jurisdictions where this sale or offering may be unlawful.

Visit CryptInc.com to invest.

Details:

Market

Broadly speaking, we operate in the Cyber Security market, which has a total size of $153bn and is growing at 11% CAGR.

(source: https://www.statista.com/statistics/595182/worldwide-security-as-a-service-market-size/)

Our headline product, CryptoPhoto, straddles several different market segments, including:-

- Multifactor Authentication: $6bn global market rapidly growing at 15% CAGR Source: "The global multi-factor authentication (MFA) market size is expected to reach USD 17.76 billion by 2025, according to a new study by Grand View Research, Inc., experiencing a CAGR of 15.07%"

- Mobile Authentication: $860M with massive growth of 25.4% CAGR Source: "$0.86 billion in 2016 to reach $3.36 billion by 2022 with a CAGR of 25.4%."

- Identity and Access Management: $14bn market growing at 13.7% CAGR Source: "The global identity and access management market size is likely to reach USD 24.55 billion by 2022, according to a report by Grand View Research, Inc. It is expected to exhibit a 13.7% CAGR from 2015 to 2022. "

- Anti-Fraud: $14bn growing at 19.6% CAGR Source: "The Global Fraud Detection & Prevention Market size is expected to reach $42.6 billion by 2023, rising at a market growth of 19.6% CAGR during the forecast period."

- Identity: $9bn growing at 2% CAGR Source: "The global market for Personal ID credentials was valued at $8.7 billion in 2016, and is forecast to reach $9.7 billion by 2021. The increase in market growth equals a global compound annual growth rate over the 5 years of 2%."

- Total market addressed by CryptoPhoto in 2018: $44bn with overall growth of 13.6% CAGR

https://www.grandviewresearch.com/press-release/global-multi-factor-authentication-mfa-market

https://www.reuters.com/brandfeatures/venture-capital/article?id=6281

https://www.reuters.com/brandfeatures/venture-capital/article?id=11155

https://www.grandviewresearch.com/press-release/global-identity-access-management-market)

https://www.alliedmarketresearch.com/fraud-detection-and-prevention-market

https://www.rtinsights.com/fraud-detection-prevention-market-to-top-40-million-by-2023/

https://www.reportbuyer.com/product/5123758/global-fraud-detection-and-prevention-market-analysis-2017-2023.html

https://www.secureidnews.com/news-item/report-personal-identity-market-worth-9.7b-by-2021/

Our pipeline products and services address many additional market segments.

Existing products and services

CryptoPhoto is our flagship multi-factor mutual-authentication and transaction signing solution. It is deployed as a product (on-premise authentication), or as a service (SaaS solution), with a range of different revenue models, price points, and upgradable features. As of August 2018, there are 439 providers employing 881 administrators who are registered with our product, with a combined user base of 31,231 end users.

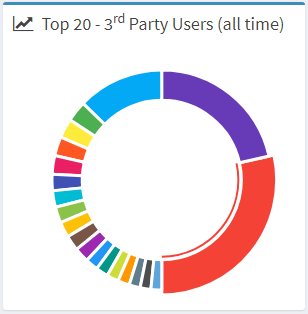

Breakdown of users per provider as-at August 2018

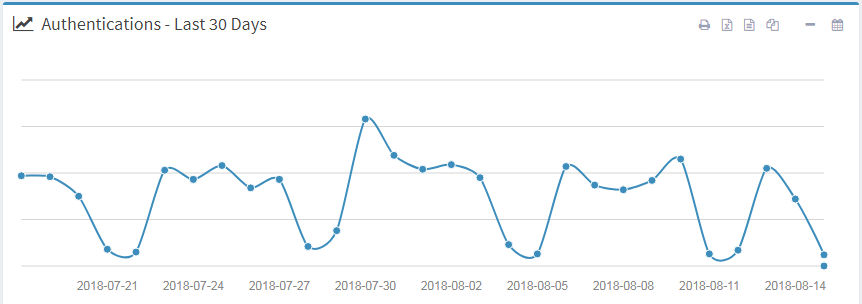

Breakdown of authentication usage patterns over time - business users (people not working on weekends) dominate our users.

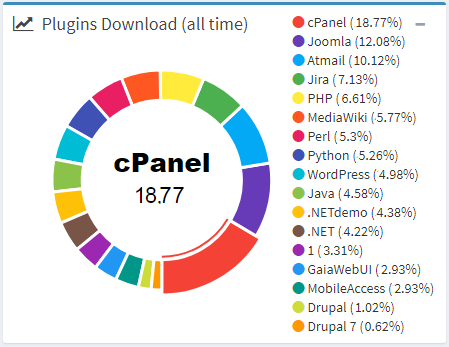

CryptoPhoto works immediately across many different products using our wide range of easy-to-install plugins. Their relative popularity is shown above.

Our solution has won numerous awards for innovation and security, and we are graduates of several start-up accelerator programs with access to a large network of alumni resources.

Pipeline products and services

CryptoPhoto is the culmination of 11 years of intense development effort, with more than a hundred significant security innovations; with each individually patent-protected. ($44bn total market, 13.6% CAGR). Many of these techniques lend themselves to spin-off products for use in other cyber-security situations. Some of our upcoming solutions which are near completion include:

Anti-Fraud and Anti-Robot Service. A new machine-DNA-based, high-reliability, invisible real-time detector of malicious users, improper intent, and robots, with low to none false-positive rates. We utilize patent-protected server-side machine-learning with threat deception to block the bad guys from deconstructing or subverting our detection methods, with no interference at all to humans and honest users. Estimated time-to-market: under 12 months. ($14bn+ market, 19.6% CAGR)

Cloud Server Encryption Service. Our boot-integrated remote authenticator facilitates the protection of cloud-based virtual machines against host-based tampering, theft, and intrusion, and protects data loss either directly,

or loss from backup or disk thefts (including removed failed drives), protects against datacentre attacks, or malicious operators. We use real-time out-of-band signalling in combination with CryptoPhoto to communicate pre-boot system integrity to

authorized administrators, and to receive decryption keys to allow remote cloud server to start or re-start in otherwise headless environments. Estimated time-to-market: under 18 months.

($5bn market, 27.4% CAGR)

https://www.marketsandmarkets.com/PressReleases/encryption-software.asp

Identity and Access Management Integration. CryptoPhoto was built as the user-facing security necessary to protect digital identities against theft and make them easy to use for all citizens, in every situation. Our suite of identity solutions are already integrated with CryptoPhoto, and our IAM connectors will make federated identity simple and powerfully strong for our customers. Estimated time-to-market: varies dependent on connector type; typically under 3 months from requirement to delivery. ($14bn market, 13.7% CAGR)

Password Manager. We believe passwords are useless, and CryptoPhoto exists to help get rid of them, but this will take time - so meanwhile, our password manager solution lets you easily access all your legacy websites from any of your devices,

with one-tap logins (including automatic OTP authenticator code provision), multiple personas, and peer-to-peer based sync - ensuring the only machines that store your passwords are the ones you own yourself. Estimated time-to-market: 18 months.

($500M market, 19.4% CAGR)

https://www.prnewswire.com/news-releases/password-management-market-size-worth-205-billion-by-2025-grand-view-research-inc-678733983.html

IoT Development Kit. CryptoPhoto supports on-demand use, for tasks like opening garages, unlocking doors, managing alarm systems, and anything inventors might dream up that can benefit from A+ high-security TLS with AAL3 strong authentication. Our IoT SDK and sample code will guide developers through the (simple) task of adding best-in-class protection to their internet-of-things projects. Estimated time-to-market: under 12 months.

Data Diode Logger. Our one-way optical-fibre indelible security archive logging solution is an open-source-based hardware device which accepts encrypted or plaintext input of any kind (typically log data such as network security events, auditing,

or financial instructions; but also file and database backups etc), and sends it over a one-way error-corrected fault-tolerant optical fibre diode link for permanent plaintext or encrypted semi-offline storage.

Due to the write-only one-way hardware involved, it is impervious to destruction or modification no matter the severity of any security breach that the customer might suffer. The network side supports cat5 ethernet, wifi, and Bluetooth.

The storage side supports USB, SD, SSD, and SATA storage, and can utilize a variety of file system formats to help keep logs organized and (offline) accessible/usable. Estimated time-to-market: 18 months.

($7.3bn market, 10.9% CAGR)

https://www.prnewswire.com/news-releases/the-global-data-backup-and-recovery-market-size-is-expected-to-reach-129-billion-by-2023-rising-at-a-market-growth-of-109-cagr-300588552.html

Off-The-Shelf (OTS) Security Solution. CryptoPhoto products are an important part of a strong security posture, but they're not the only part - to run a properly secured company or department, a huge range of products and technologies are needed, and must be properly configured. Operating policies and staff procedures and training are also important, along with testing, certifications, maintenance, updates, and more. Modern security is complicated - every part needs its own cyber expert to select the best devices and solutions, and to set up, monitor, and maintain. The CryptoPhoto OTS package will be a single solution incorporating all the products and services needed to give our customers the most complete assurance possible that the entirety of their infrastructure is the right solution, set up properly, and optimally protecting them. In short, "Peace of Mind, as a service". Inexplicably, we are not aware of anything like this yet available on the market, despite the outstanding demand across all business and government sectors. ($16bn market, 15.6% CAGR) https://www.transparencymarketresearch.com/pressrelease/managed-cyber-security-services-market.htm

Mil_Spec 2-way Authenticator. This is a hardware device with optional camera, optional microphone, optional speaker, and optional networking, providing high-strength cryptographic key use and storage in a package that can provide AAL3

mutual-authentication protection and cryptographic signing and key release/provision, which is suitable for use in classified environments, including those that prohibit camera/microphone/network/storage device carriage.

Estimated time-to-market: 24 months; earlier (as short as 9 months) if required by customers. We have fully-functioning proof-of-concept devices for sales-promotion, demonstration, and evaluation purposes already.

($243M market, 7.5% CAGR)

Mil_Spec 2-way Authenticator. This is a hardware device with optional camera, optional microphone, optional speaker, and optional networking, providing high-strength cryptographic key use and storage in a package that can provide AAL3

mutual-authentication protection and cryptographic signing and key release/provision, which is suitable for use in classified environments, including those that prohibit camera/microphone/network/storage device carriage.

Estimated time-to-market: 24 months; earlier (as short as 9 months) if required by customers. We have fully-functioning proof-of-concept devices for sales-promotion, demonstration, and evaluation purposes already.

($243M market, 7.5% CAGR)

https://www.mordorintelligence.com/industry-reports/hardware-otp-token-authentication

The above listed pipeline projects are 100% owned by CryptoPhoto. If you become a shareholder (by purchasing CP tokens) you will become a proportional owner of all of these projects.

Scalability

All current and pipeline CryptoPhoto products use architectures that facilitate rapid scaling and high-volume use, with little to no associated increase in our costs.

Company History & structure/related entities

CryptoPhoto was conceived in 2007 and patented by founder Chris Drake. The company's landmark product was the culmination of 25 years cyber-security experiences gained through professional roles in enterprise, mining, gaming, banking, and defence. The first patent was granted in 2011 and the company founded shortly after to build the worlds' first authentication solution specifically designed to defend ordinary users against the full range of modern cyber threats. Since then, our now-mature product has received numerous industry awards, our company has received $millions in start-up grant funding, we have graduated from several prestigious accelerators, and we have amassed hundreds of installations with tens of thousands of users.

CryptoPhoto.com Pty Ltd is 100% owned by 1id Inc, the Director/CEO of both is Chris Drake. 97.4% of 1id Inc is currently owned by Chris Drake, the balance being owned by advisors.

Key Assets, Contracts & IP

CryptoPhoto owns or benefits from several granted and pending Patents, including:

- US8,176,332 "Computer Security using Visual Authentication",

- US6,006,328 "Computer Software Authentication, Protection, and Security System" (the most widely cited security patent in the world, and still valuable for litigation), and

- US20170346851 "Mutual Authentication Security System with Detection and Mitigation of Active Man-In-The-Middle Browser Attacks, Phishing, and Malware and Other Security Improvements".

We have a signed agreement to integrate our multi-factor protection technology with a core banking provider, who powers 280 banks across 80 countries. We have an executed agreement and integration of our technology with the world's largest global provider of cybersecurity products. We have good working relationships with hundreds of potential customers, all of whom have been impressed with our technology. We have never been turned away by a CISO, and always impress them with our solutions.

Refer to the above sections "Existing/Pipeline products and services" for details of our other assets.

Funding & Use of Funds (inc R&D)

We propose to allocate our $10M raise to our sales teams as follows:

Silicon Valley: $2M. This is home to some of our important strategic partners, and HQ to a large number of valuable customers.

New York: $2M. This is home to a large number of valuable potential customers.

London: $2M. This is also home to a large number of valuable potential customers, and on the doorstep to the rest of Europe.

Chennai: $2M. Much of the software used by the majority of our most valuable customers is produced here, and we have an existing agreement with one of the world's largest outsourcing firms to integrate our solution with their products. Our Chennai team will help secure sales into the local market, as well as among the customers of these outsourcing companies.

Sydney/APAC: $1.5M. We need a team in Australia to help close the many deals we currently have in play. This team will also service Asian markets close-by, including Singapore and other financial centres. Our APAC team will also be responsible for Chinese translation and recruitment of expert sales staff based in China.

All-Teams sales resources: $0.5M. Production of professional marketing materials and event costs will help all our teams reach their goals.

Offer details

Information on the company's management and shareholders

Board of Directors and Directors

Chris Drake

Senior Management

Chris Drake

Remuneration / Compensation of Senior Management

$185,600 p.a.

Corporate Governance

Chris Drake

Shareholders

97.4% Chris Drake

2.6% Advisors

Dividends, Dividend Policy and Stock Options

We practice a hybrid stability/residual dividend policy.

Dividends are paid exclusively in reclaimed stock according to the principles of an Open Transparent Company (you will receive additional shares to pay your dividend, after the company has purchased (bought back) sufficient to distribute the dividend, in the form of those shares, to remaining shareholders).

No stock options exist.

Description of the Company's Shares

All one trillion shares are ordinary common stock. There are no preference shares.

Material Transactions / Agreements with Major Shareholders

None.

Material Transactions / Agreements with Senior Management

None.

Other Conflicts of Interests

None.

Investor Information: Incentives, Deal structure

Up to $110,000 of company capital will be available as investment incentives to strategic and early investors, in the form of small discounts on their share purchase prices.

Legal Proceedings / Litigations

None.

Risks & Mitigation

Purchasing shares and CP-Tokens carry risks. You should carefully consider the risks you face, including but not limited to those outlined in this document, and where appropriate, obtain professional advice before taking ownership of CP-Tokens.

You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus before making a decision to invest in our stock. The risks and uncertainties described below may not be the only ones we face. If any of the risks actually occur, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the market price of our stock could decline, and you could lose part or all of your investment.

By purchasing CP-Tokens, to the extent permitted by law, you acknowledge and agree that there are risks associated with this. You expressly acknowledge and assume all risks and agree not to hold CryptoPhoto, any selling parties or underwriters, or any related party liable for any loss, damage, cost or expense (including any special, incidental, or consequential damages) arising from, or in any way connected, to the sale of CP-Tokens, including, but not limited to, any loss associated with the risks set out herein and below.

Risk of user CP-Token loss from equipment failure, key loss or compromise, etc

1. Us

Loss of key material would prevent the continued operation of our smart "Open Company" contract along with other undesirable effects. This is mitigated using two mechanisms: should such a disaster occur, no actual financial loss would result,

and we are able to produce a new contract and transition all customers to this with minimal effort.

To prevent this risk in the first place, all keys used in CryptoPhoto and our partner exchange are generated entirely offline on a secure appliance which has no network connectivity, and is protected against fire, flood, theft etc.

Copies of all keys are additionally made on encrypted media and stored safely offsite in the hands of totally trusted individuals who understand the recovery mechanisms needed in the event that our offline mechanism or its staff become unavailable.

None of our online servers hold key material, and we practice a strong defence-in-depth architecture to prevent malicious attempted thefts and transactions.

2. You

Shareholders have the option to transfer their shares (CP-Tokens) off the exchange for storage in their own wallets. Should you choose to do this, you face additional risks of token theft via malware, social engineers, scamming,

and malicious alterations to the wallets or storage mechanisms you make use of. If you lose or forget your keys or passwords, or your devices holding them are lost, stolen, destroyed, expire, or fail, your CP-Tokens may be rendered irrevocably lost.

Caution: please be sure you fully understand the risks, security measures, and backup/recovery mechanisms needed to adequately safeguard your CP-Token investment before you choose to transfer your CP-Tokens off the exchange.

3. Succession Planning

If you are struck by a tragedy, your heirs may not know about, or be able to access, your CP-Tokens. Please ensure that any beneficiaries you nominate for your estate know about your CP-Tokens, and how to access them.

Please take care to protect yourself against "friendly fraud" (token thefts by individuals who you trust, or who may have early access to your succession plans)

Risk of sales failure.

CryptoPhoto is clearly better than competing solutions, but it's different. We are counting on success at recruiting experienced cyber sales professionals with the necessary skills to sell our improved security to organizations, many of whom may already be using inferior competing products, and who may be unwilling to adopt our different authentication approach, even though it's faster, easier, and safer. There is a risk that it may be difficult or impossible to convince customers to upgrade to our protection.

Risk of tragedy affecting Key personnel.

We have trusted individuals in different continents with the training and secure key material needed to recover from any event affecting any of our staff. The CryptoPhoto business operates with no single point of failure.

Risk of users falling prey to social-engineering scams.

ICOs are often plagued by scammers impersonating the ICO. Please ensure that you obtained this document directly from the CryptoPhoto web site, and any purchases you make are done through our partner exchange CryptInc.com.

Risk of account lockout at CryptInc.com Exchange.

If customers do not take their own security seriously, and manage to lose or destroy both their primary and backup authentication mechanisms, and have not completed our "Know Your Customer" (KYC) verification, there may be no way that the exchange can reliably verify that a claim on an account is from the original legitimate owner, which could lead to loss of investment. Customers should be diligent and treat their authentication tokens with appropriate care to safeguard their account. Spare recovery tokens can be produced for free, and should be stored with good physical security and disaster planning by the customer.

Risks associated with distributed ledger (blockchain) technologies.

Advances in cryptanalysis, quantum computing, or consensus-network exploits, or regulations/bans on them by governments, or forks/abandonment of Ethereum or other protocols used by CP-Tokens may adversely affect your CP-Tokens and/or ability to hold, trade, or use them. The CryptoPhoto business is not reliant on any particular blockchain, or even on blockchain itself, which we hope gives us excellent chances to overcome any such events.

Risk of Mining-based attacks.

The validation and consensus mechanisms of the blockchains holding CP-Tokens are typically at risk of assorted attacks that could be mounted by adversaries with powerful compute and/or network infrastructures. Any successful attacks pose a risk to your CP-Tokens.

Risk of Security oversights and Hacking.

Malicious actors may attempt to interfere with the Platform or CP-Tokens in a variety of ways, including, but not limited to, malware attacks, denial of service attacks, consensus-based attacks, Sybil attacks, smurfing and spoofing. As CryptoPhoto uses open-source software components, there is a risk that any party may intentionally or unintentionally introduce weaknesses into the core infrastructure of CryptoPhoto, which could negatively affect CryptoPhoto and CP-Tokens. Hackers, individuals, other groups or organizations may attempt to steal the BTC and ETH cryptocurrency from our ICO, thus potentially impacting the ability of CryptoPhoto to reach our goal. To account for this risk, we maintain security precautions to safeguard the BTC and ETH obtained from the sale of CP-Tokens, including the use of multiple smaller wallets, and the exclusive use of keys held offline. The CryptoPhoto security solution itself is used to protect the exchange and CP-Tokens. Advances in code cracking, or technical advances such as the development of quantum computers, could present risks to cryptographic tokens and CryptoPhoto, which could result in the theft or loss of CP-Tokens. To the extent possible, CryptoPhoto intends to update the protocol underlying CryptoPhoto to account for any advances in cryptography and to incorporate additional security measures, but it cannot predict the future of cryptography or the success of any future security updates.

Risks associated with Exchanges.

CryptoPhoto cannot control the actions of Purchasers of CP-Tokens. Even if secondary trading of CP-Tokens is facilitated by third party exchanges, such exchanges may be relatively new and subject to little or no regulatory oversight, making them more susceptible to fraud or manipulation. Furthermore, to the extent those third parties do ascribe an external exchange value to CP-Tokens (e.g. as denominated in a digital or fiat currency), such value may be extremely volatile and diminish to zero.

Cryptocurrency exchanges on which CP-Tokens may trade may be relatively new and largely unregulated and may therefore be more exposed to fraud and failure than established regulated exchanges. To the extent that the cryptocurrency exchanges representing a substantial portion of the volume in CP-Token trading are involved in fraud or experience security failures or other operational issues, such cryptocurrency exchange failures may result in a reduction in the price and can adversely affect the value of CP-Tokens. A lack of stability in the cryptocurrency exchanges and the closure or temporary shutdown of cryptocurrency exchanges due to fraud, business failure, hackers or malware, or government-mandated regulation, or other reasons may reduce confidence in CryptoPhoto and result in greater volatility in the price of CP-Tokens.

Risk of Market.

While we unreservedly believe in the superiority of our solution, and dozens of awards demonstrate that experts in our field do too, there is always the chance that potential customers may not be willing to adopt our improved security system, or that competing products or solutions might be launched.

Risk of Uninsured and Transaction losses.

CP-Tokens are uninsured unless you specifically obtain private insurance to insure those held by you. In the event of loss or loss of value, there is no public insurer or private insurance arranged by CryptoPhoto to offer recourse to you. CP-Token transactions are irrevocable. If CP-Tokens are stolen or incorrectly transferred, such transfer may be irreversible. As a result, any incorrectly executed CP-Token transactions could adversely affect the value of CP-Tokens. Cryptographic token transactions are not reversible without the consent and active participation of the recipient of the transaction or, in theory, control or consent of a majority of the processing power on the host blockchain platform. Once a transaction has been verified and recorded in a block that is added to the blockchain, an incorrect transfer or theft of a CP-Token generally will not be reversible. There may be no compensation for any such transfer or theft. Any such loss could adversely affect the value of CP-Tokens generally.

Risks associated with uncertain regulations, enforcement actions and geopolitical events.

The regulatory status of cryptographic tokens, blockchain and distributed ledger technology is unclear or unsettled in many jurisdictions. It is difficult to predict how or whether regulatory agencies may apply existing regulation with respect to such technology and its applications, including CP-Tokens. It is likewise difficult to predict how or whether legislatures or regulatory agencies may implement changes to law and regulation affecting blockchain and distributed ledger technology and its applications, including CP-Tokens.

Regulatory actions could negatively impact CP-Tokens in various ways. CryptoPhoto may cease operations or may restrict CP-Token trading in a jurisdiction in the event that regulatory actions, or changes to law or regulation, make it illegal to operate in such jurisdiction, or commercially undesirable or prohibitive to obtain the necessary regulatory approval(s) to operate in such jurisdiction. CryptoPhoto could be impacted by one or more regulatory enquiries or regulatory action, which could impede or limit the ability of CryptoPhoto to reach our goals. Political or economic crises may motivate large-scale sales of CP-Tokens, which could result in a reduction in the price and adversely affect the value of CryptoPhoto. Cryptographic tokens such as CP-Tokens, which are relatively new, are subject to supply and demand forces based upon the desirability of an alternative, decentralised means of transacting, and it is unclear how such supply and demand will be impacted by geopolitical events. Large-scale sales of CP-Tokens could result in a reduction in the liquidity of such tokens.

Risks arising from Taxation.

The tax characterization of CP-Tokens is uncertain in many jurisdictions. You must seek your own tax advice in connection with purchasing CP-Tokens, which may result in adverse tax consequences to you, including but not limited to withholding taxes, income taxes and tax reporting requirements. You bear the sole responsibility for any taxation requirements, in purchasing, using and holding CP-Tokens.

Risk of insufficient Interest in CryptoPhoto.

It is possible that our ICO will not be subscribed to by large enough numbers of people and/or that there will be limited public interest in the ownership or trading of CP-Tokens. Such a lack of interest could impact the ability of CryptoPhoto to reach our goals, or may impact the price and liquidity of CP-Tokens. CryptoPhoto cannot predict the success of its own marketing efforts or the efforts of other third parties. It is possible that, due to any number of reasons, including without limitation, the failure of business relationships or marketing strategies, that CryptoPhoto and all subsequent marketing of the sale of CP-Tokens from CryptoPhoto, may fail to achieve a sustainable business proposition.

Risk of unfavourable fluctuation of crypto or other currency value.

CryptoPhoto intends to use the proceeds from selling CP-Tokens to fund our sales expansion. Portions of the ICO sale will be denominated in BTC and ETH, and can be converted into other cryptographic and fiat currencies. In addition, some sales may also be denominated in fiat currencies. If the value of BTC, ETH or other currencies fluctuate unfavourably during or after the Sale Period, CryptoPhoto may not be able to meet its funding goals, or may not be able to reach our market goals to our intended degree.

Risk of dissolution of CryptoPhoto.

It is possible, due to any number of reasons including, but not limited to, an unfavourable fluctuation in the value of Ether (or other cryptographic and fiat currencies), decrease in customer demand for strong security, uncertain or changing regulatory regimes, the failure of commercial relationships, unfavorable action taken by our banks or Governments, or intellectual property ownership challenges, that CryptoPhoto may no longer be viable to operate and CryptoPhoto may dissolve or be wound up.

Risks arising from monopoly governance rights.

While ownership of a CP-Token confers shareholder voting and other rights, the majority of CP-Tokens remain owned and controlled by CryptoPhoto founders, effectively limiting the governance opportunities of shareholders. All decisions involving the CryptoPhoto will be made in accordance with Marshall Islands companies laws by its founders at their sole discretion, including, but not limited to, any decisions to discontinue CryptoPhoto, to change, modify, or migrate CP-Tokens, or to sell or liquidate CryptoPhoto. These decisions could adversely affect our Platform and any CP-Tokens you hold.

Risk of Cyber Attack.

CryptoPhoto technology is developed and maintained on physical servers owned and controlled by CryptoPhoto, with regular off-site backups, however, it is possible that sophisticated attacks may adversely affect our operations and reputation, which may consequentially affect CP-Token prices.

Cryptographic tokens may experience risk of extreme price volatility.

While CP-Tokens represent formal company shareholdings, such representation is rare in the industry, and may not be well understood by investors.

Cryptographic tokens that possess value in public markets, such as ETH and BTC, have demonstrated extreme fluctuations in price over short periods of time on a regular basis. While this makes no sense for a Security-Token such as ours, you should nevertheless be prepared for the possibility of similar fluctuations, both down and up, in the price of CP-Tokens. Such fluctuations are due to market forces beyond our control.

3rd party exchanges other than our partner CryptInc.com are independent of and not operated by CryptoPhoto, therefore use of those exchanges is at your own risk. CryptInc.com is not operated by CryptoPhoto, but is operated by CryptoPhoto founders and as such represents a lower risk than 3rd party exchanges.

CryptoPhoto cannot and does not guarantee market liquidity for CP-Tokens and therefore there may be periods of time in which CP-Tokens are difficult to buy or sell. Additionally, due to different regulatory requirements in different jurisdictions and the inability of citizens of certain countries to open accounts at exchanges located anywhere in the world, the liquidity of CP-Tokens may be markedly different in different countries and this may likely be reflected in significant price discrepancies.

By purchasing CP-Tokens, you expressly acknowledge and represent that you fully understand that CP-Tokens may experience volatility in pricing and will not seek to hold any of CryptoPhoto, its selling parties or underwriters, its directors, officers, agents, advisors or related parties liable for any losses or any special, incidental, or consequential damages arising from, or in any way connected to, the purchase and/or sale of CP-Tokens.

It is also possible that the value of BTC or ETH will drop significantly in the future, depriving CryptoPhoto of sufficient resources to continue to operate.

It is possible that a competing solution CryptoPhoto could have features that make it more desirable to a material portion of our customer base, resulting in a reduction in demand for CP-Tokens, which could have a negative impact on the value of the company and price of CP-Tokens generally. It is possible that a comparable product could become materially popular due to either a perceived or exposed shortcoming of CryptoPhoto that is not immediately addressed by CryptoPhoto, or a perceived advantage of a comparable product that includes features not incorporated into CryptoPhoto. If this product obtains significant market share, it could have a negative impact on the demand for, and price of CP-Tokens.

CryptoPhoto is a relatively new product, a factor that may contribute to price volatility that could adversely affect the value of CP-Tokens. There are many factors affecting the further development of the cryptographic token industry, as discussed throughout this section. These risks can include, but are not limited to: continued worldwide growth in the adoption and use of CP-Tokens and other tokens; changes in consumer demographics; public perception of blockchain technology; public tastes and preferences; general economic conditions; and the regulatory environment relating to Cyber Security, CP-Tokens, Security Tokens, and other tokens.

Risk of intellectual property rights claims.

Intellectual property rights claims may adversely affect the operation of CryptoPhoto. Third parties may assert intellectual property ownership claims relating to the holding and transfer of cryptographic tokens, or aspects of the CryptoPhoto cyber solution. Regardless of the merit of any intellectual property claim or other legal action, any threatened action that reduces confidence in CryptoPhoto's long term viability or the ability of end-users to hold and transfer CP-Tokens, may adversely affect the value of CP-Tokens. Additionally, a meritorious intellectual property claim could prevent you from accessing, holding or transferring your CP-Tokens.

Unanticipated risks.

Cryptographic tokens such as CP-Tokens are a new and relatively untested technology. In addition to the risks noted above, there are other risks associated with your purchase, holding and use of CP-Tokens, including those that CryptoPhoto cannot anticipate. Such risks may further materialise as unanticipated variations or combinations of the risks set out above.

Revenue Models

Basic CryptoPhoto pricing starts at $1/user/month, with discounts available for volume use, concessions for social enterprise, and revenue-sharing (in-app-purchase) opportunities for community projects. We support SaaS (Software/Security as-a-service) and/or on-premise (enterprise appliance based) delivery, the latter incurring additional appliance and maintenance costs. We support a range of additional functionality that can be enabled for small additional cost.

(see our pricing info here: https://cryptophoto.com/pricing.html )

Competitors

CryptoPhoto is dramatically different to existing industry competitors, taking an entirely different approach: our solution protects the user against the widest range of threats at all times. Almost all other vendors simply implement some variation of 1984 OTP (one-time-password) technology, which is widely known to be generally ineffective against most modern threats, since it does not provide complete user protection at all. Competitors typically only provide an ineffective, partial solution and ignore most of the security problem, leaving the rest to other products and the users themselves to try and stay safe. Because the 1984 OTP patent expired a long time ago, there are literally hundreds of copycat vendors servicing this market. Some of the well-known ones are:

| MFA product competitors and comparison | |||||||

|---|---|---|---|---|---|---|---|

| Vendor | Price per 100 tokens per year | Server methods | Mobile OS supported | Types of tokens | API guide | Signing (antimalware) | Strength |

| NokNok Labs S3 Authentication Suite | Starts at $50,000 | SaaS, Linux server | Android, iOS | Mobile | No | No | AAL1(low) |

| PistolStar PortalGuard | $15,000 setup + $5000/yr | SaaS, Linux server | Android, iOS | Mobile | No | No | AAL1(low) |

| RSA Authentication Manager | Starts at $7500 (one-time) | Appliance, Linux VM | Android, Blackberry, Windows Mobile, iOS | SMS, mobile, email, hardware | No | No | AAL1(low) |

| Gemalto SafeNet Authentication Service | $1,200/yr | SaaS, Windows Server | Android, Blackberry, Windows Mobile, iOS | Mobile, hardware, email, SMS | Yes | No | AAL1(low) |

| Symantec VIP | $2000 (setup fee)+ $5500/yr | SaaS | Android, Blackberry, Windows Phone, iOS | Voice, biometrics, mobile, email, SMS | No | No | AAL1(low) |

| TextPower SnapID | free | SaaS | Any mobile phone | SMS | No | No | AAL1(low) |

| Vasco Identikey Authorization Server + Digipass | $6000 + $1000 | Windows, Linux, appliance, SaaS | Android, Blackberry, Windows Mobile, iOS | Mobile, voice, SMS , email, hardware | Yes | No | AAL1(low) |

| VSP Group Biometrics | $500/yr min. | SaaS | Any mobile phone | Biometrics, voice, SMS | No | No | AAL1(low) |

| Yubico Yubikey | $3500 setup | SaaS | None | Hardware token | Yes | No | AAL1(low) |

| CryptoPhoto | $1200++ | SaaS or on-premise appliance physical/VM | Android, Blackberry, Windows Mobile, iOS | Mobile, Hardware, wallet | Yes | Yes | AAL3(high) |

++ additional costs for additional features, uses, and/or devices

Exit

While competitors in our industry with moderate traction tend to change hands for hundreds of millions, or even more than $1bn USD, our plans at this stage are to grow our company, introduce additional product lines, and not seek a buy-out. The unparalleled significance of our superior existing protection, and the potential additional value of our pipeline products combine to plausibly achieve annual incomes exceeding $1bn - representing significant possible upside.

Comparable Industry acquisitions

| Recent industry acquisitions of comparable* products | |||

|---|---|---|---|

| Company | Price paid | Acquirer | Details |

| DUO Security | $2.35 billion, August 2018 | CISCO | Multifactor Authentication. Their first funding was just $1m in 2010. Tech Crunch article |

| Gigya | $350 million, September 2017 | SAP | Web identity management (a principal use case for CryptoPhoto). Started with $4m in 2007. Article |

| Guidance Software | $240 million, July 2017 | Covisint | Endpoint security. From $7.5M in 2012. Article. |

| Delta ID | $106 million, June 2017 | Fingerprint Cards | Biometric technology. From $15M over 3 rounds from 2013. Article |

| Veracode | $614 million, March 2017 | CA Technologies | Security Verification. From $7.5M in 2006. Article |

| Threatmetrix | $817 million, January 2018 | Relx | Risk-Based Authentication and Anti-Fraud. From $5.5M in 2008. Techcrunch Article |

| Phishme | $400 million, February 2018 | Blackrock | Human-Factor security and anti-phishing. From $2.5M in 2012. Article |

| Ping Identity | $600 million, June 2016 | Vista Equity Partners | Federated Identity. From $5.8M in 2004. Article |

Conditions

You should rely only on the information contained or incorporated by reference in this prospectus.

CP-Tokens are securities - they are ownership shares, and are regulated by the Marshall Islands Business Corporations Act, and as such require the recording of owner names, share types and quantities, and voting rights in our share register. Accordingly, CP-Tokens are available only to persons who identify themselves for this purpose.

Neither we, nor any selling parties or underwriters (1) have authorized anyone to provide you with any information other than the information contained or incorporated by reference in this prospectus, or (2) are making an offer to sell securities in any jurisdiction where the offer or sale is not permitted.

The information contained or incorporated by reference in this prospectus is accurate only as of the date thereof, regardless of the time of delivery of this prospectus or of any sale of our shares or tokens. Our business, financial condition and results of operations may have changed since that date. It is important for you to read and consider all the information contained in this prospectus, including the documents incorporated by reference herein, before making your investment decision.

No action has been taken that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required. Persons who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our shares or tokens, the distribution of this prospectus in their jurisdiction, or the promotion of our offering.

This offering is not available to Cuba, Iran, North Korea, Marshall Islands, Sudan, Syria, Venezuela, or any countries sanctioned by the USA or its allies, nor to any peoples or companies thereof, nor is it available in any jurisdiction where this sale, offering, or promotion may be unlawful.

How to Invest

A note from founder Chris Drake:

CryptoPhoto is the pinnacle of my life's work. I hope this prospectus addresses all your information needs. If you have questions or wish to join our community of existing investors, please head to our Telegram, Twitter, or Facebook channels.

I am available to speak personally with investors by phone, skype, whatsapp, and other methods; please use our website "contact" system to set up an appointment, or connect with me on LinkedIn.

After you're satisfied you meet our investor conditions:-

- Refer to our ICO summary website for an overview of our offering and investor links.

- Visit the Crypt Inc exchange to purchase CP tokens and become an investor and shareholder in our company!

Appendix:

1id Inc Bylaws and Articles of Association

1ID INC Owns 100% of CryptoPhoto.com Pty. Ltd.

Click here to view the 1id Inc Bylaws and Articles of Association (opens in new window)

CryptoPhoto.com Pty. Ltd. Articles of Association

Click here to view the CryptoPhoto.com Pty. Ltd. Company Constitution (opens in new window)

Adobe PDF version of this Prospectus.

Click here: CP_Prospectus.pdf (opens in new window; right-click to save)

© Copyright 2018 CryptoPhoto. All rights reserved.

Issuing Entity: 1id Inc. (Marshall Islands Reg. No. 96956).

Loading ...

Loading ...